The Impact of CMS CDAG on Medicare Advantage Organizations

MedAdvantage360

When we decide to purchase a product or service, we look for its ratings or reviews. These online ratings are provided by consumers who have brought or experienced the product/service and are in a position to provide their feedback. In the world of medicare advantage, CMS conducts various audits on the health plans that sell health insurance products (health insurance) and provide star ratings based on the plan's quality and performance.

The CMS audit program includes multiple areas— this story focuses on CDAG: Part D Coverage Determinations, Appeals, and Grievances. The document reviews the member appeal process, typical challenges faced by health plan in processing the appeal, how CMS oversees this process and the impact it has on the health plans' star ratings.

Although rejections are a part of the health insurance process, how can health plans ensure such rejections do not impact members and what can members do to reverse the determination (overturn denial) in their favor.

What happens when a denial notice is served?

Health plans are generally required to provide coverage of designate health services to enrolled members, though there are instances, where the beneficiaries or providers are served with 'denial notices'. There could be many W reasons, for instance in case of a 'Part-D Plan', the health plan may say that, the drug is covered as a part of Part-B (Outpatient) and not Part-D (Prescription), or the drug is excluded from the Medicare coverage. The reasons for the denials could be many and are based on various scenarios.

Denials on Part D coverage, directly impact beneficiaries as they may be in a very critical health condition or in pain and requiring immediate assistance. This would be worse if the member is from a low income group and cannot afford to pay for the drug. So, what options do an enrolled member have in such a situation?

Pre-Appeal (coverage determination or prior authorization)

Beneficiaries have the right to file an appeal to request that the denial be overturned. Beneficiaries may submit the appeal themselves or a designated representative may submit the appeal on their behalf.

Before starting an appeal process, members must submit a written form to the drug plan and get a written coverage determination (prior authorization). Just getting a ‘no' at the pharmacy is not considered enough for a coverage determination or for starting an appeal process.

Coverage determination form submission

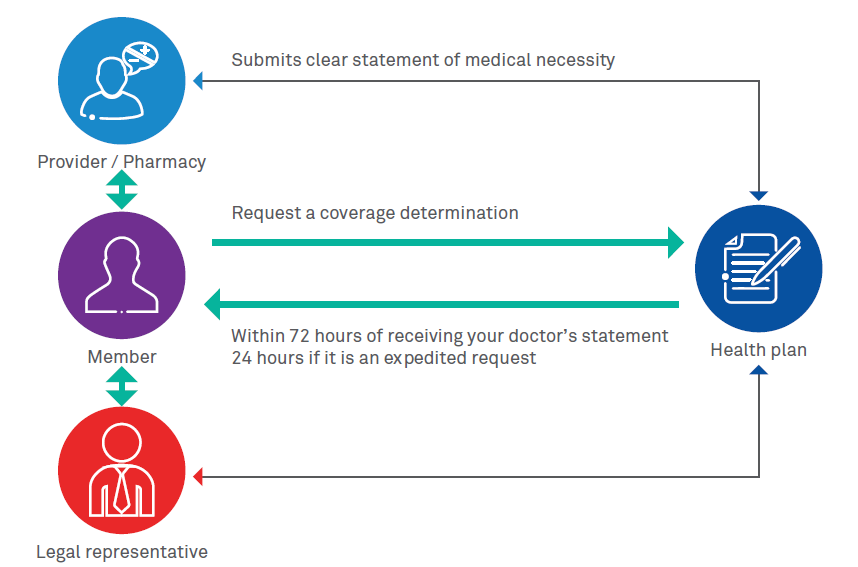

A coverage determination is a Medicare drug plan's initial decision on whether it will cover medication or not. Doctors will play an important role in this process. The only way to succeed with a coverage determination is to make sure that the prescribing doctor submits a clear statement of medical necessity and states that only the prescribed medication will work for the member. The following diagram provides an overview of coverage determination process involving key industry players.

- Member requests a coverage determination

- Provider submits a clear statement of medical necessity documentation to health plan

- Health plan has to respond and provide decision within 72 hours of receiving doctor's statement or 24 hours if it's an expedited request

Figure 1: Coverage determination or prior authorization process

Filing an appeal

Once the health plan responds in writing that it has decided not to cover a member's drug with a letter entitled, "Notice of Denial of Medicare Drug Coverage," the appeals process can begin. Here are the steps.

Figure 2: Appeal process

Appeal Process

- At the first level, most appeals are reviewed by the health plan that issued the denial. The plan will perform redetermination.

- Appeals for certain types of services are independently reviewed by Quality Improvement Organizations (QIO)

- An independent entity, Administrative Law Judge (ALJ) reviews the appeals, when they continue to the higher levels

- Finally, the Medicare Appeals Council will be involved

Processing incoming appeals - Key challenges for health plans

Let's now dive into the key challenges faced by health plans when appeals or grievances start flowing in.

Making an appropriate and quick decision within a predefined timeframe is the highest priority for any plan. Plans are faced with challenges, such as unintegrated internal systems and multiple stakeholders—member, provider, legal representative, various departments and Centers for Medicare & Medicaid Services (CMS) regulatory compliance. These diverse systems brings in the need for following capabilities for health plans:

- Ability to accurately capture the data within organizations' systems and consolidate in a single viewable state to enable appropriate decision and audit purposes

- Managing inputs from different systems– call logs, written requests, provider's Electronic Medical Record (EMR) excerpts substantiating medical necessity, health plan's internal systems

- Monitoring and alerts mechanism in tune with business rules and CMS mandates

- Action-based analytics to compile data needed to assess compliance with CMS expectations

- Eliminating processing inefficiencies related to resources, training, or expertise

-

Ability to generate and select universe (integrated reports from

different systems) and submit to CMS on a timely manner

- Pull universes: The universes collected for this program area test whether the sponsor has deficiencies related to timeliness, clinical decision making and appropriateness, and grievances and the misclassification of requests in the area of CDAG

- Appropriate outreach with a dedicated appeal and grievances system that performs intelligent and automatic outreach via fax or mail and supplements the process with phone calls

CMS' oversight of denials and appeals

As per the Office of Inspector of General, US, Medicare Advantage Organizations (MAOs) overturned 75 percent of their own denials (first step in the process prior authorization) during 2014-16, overturning approximately 216,000 denials each year.

CMS uses several tools to oversee the denial and appeal process in Medicare Advantage and to incentivize MAOs to improve their performance. These tools include program audits, compliance and enforcement actions, and quality ratings. Typically, in the beginning of the year, CMS will send out routine engagement letters to initiate audits. The engagement letter for unscheduled audits may be sent out at any time throughout the year. Typical program areas for the audits include Part C and D coverage determination, compliance program effectiveness, Medicare-Medicaid plan authorization requests, care coordination program effectiveness and audit on Part D formulary benefit administration.

Impact on star ratings

The first point in the list of audits is CDAG (Coverage Determinations, Appeals and Grievances). Plans that are unable to provide complete and accurate universes will be at risk with both their Part C and Part D star ratings and might have to face CMS enforcement actions, including Civil Money Penalties (CMPs).

Examples of appeals and IRE deficiencies found during CMS program audits include:

- Sponsor did not appropriately auto-forward coverage determinations and/or redeterminations (standard and/or expedited) for review and disposition within the CMS-required timeframe Coverage Determinations, Appeals and Grievances (CDAG)

- Sponsor failed to process expedited pre-service reconsiderations with 72 hours Organization Determinations, Appeals and Grievances (ODAG)

Products and solutions to address these challenges

Medicare Advantage Organizations (MAOs) need comprehensive end-to-end Appeals & Grievances (A&G) management process which can track every aspect of incoming appeal, grievances or complaint. The solution should enable Health Plans to:

- Reduce compliance risk

- Eliminate manual process and human errors

- Ensure they remain compliant with CMS' changing regulatory requirements

- Process, track and identify all incoming appeals, grievances and complaints

- Effectively generate correspondence and letters as per CMS specified turnaround timeframes

- Ability to produce analytical report and universes as needed by CMS audits

- Avoid costly civil monetary penalties and CMS sanctions

- Reduce the cost of developing and maintaining internal systems and manual processes

- Solution with an ability to scale and adapt to latest technologies, such as Artificial Intelligence (AI) and Machine Learning (MI) algorithms

Wipro's A&G360 application allows Medicare Advantage Organizations (MAOs) to comprehensively manage their end-to-end Appeals & Grievances (A&G) process, and contains a Complaint Tracking Module (CTM). The product enables plans to process, track and identify all incoming appeals, grievances and complaints to ensure they remain compliant with CMS' changing regulatory requirements.

References

https://oig.hhs.gov/oei/reports/oei-09-16-00410.asp - Inspector of General, US Department of Health & Human Services

https://www.cms.gov/ - Centers for Medicare & Medicaid Services

About The Author

Santosh Gundurao Gurlahosur

Healthcare Information Technology, Wipro Limited.

With over 18 years of experience in Healthcare Information Technology, Santosh brings in a blend of domain, technology, delivery & program management experience. He focuses on building products, end-to-end customer management and nurturing robust & efficient teams to manage complex Healthcare & Medicare advantage products & services. Santosh is also AHIP certified.

Modernization of a leading BCBS Health Plan

Encounter Integration with Customer Claims Vendor, Encounter

Data Processing, Risk Adjustment and Financial Projections for

Health Plan

Read More>

Leading Medicare Advantage Start-up Plan Implementation

Implemented edit logic that includes CMS and MA specific

requirements to meet CMS regulatory mandates and timelines.

Read More>